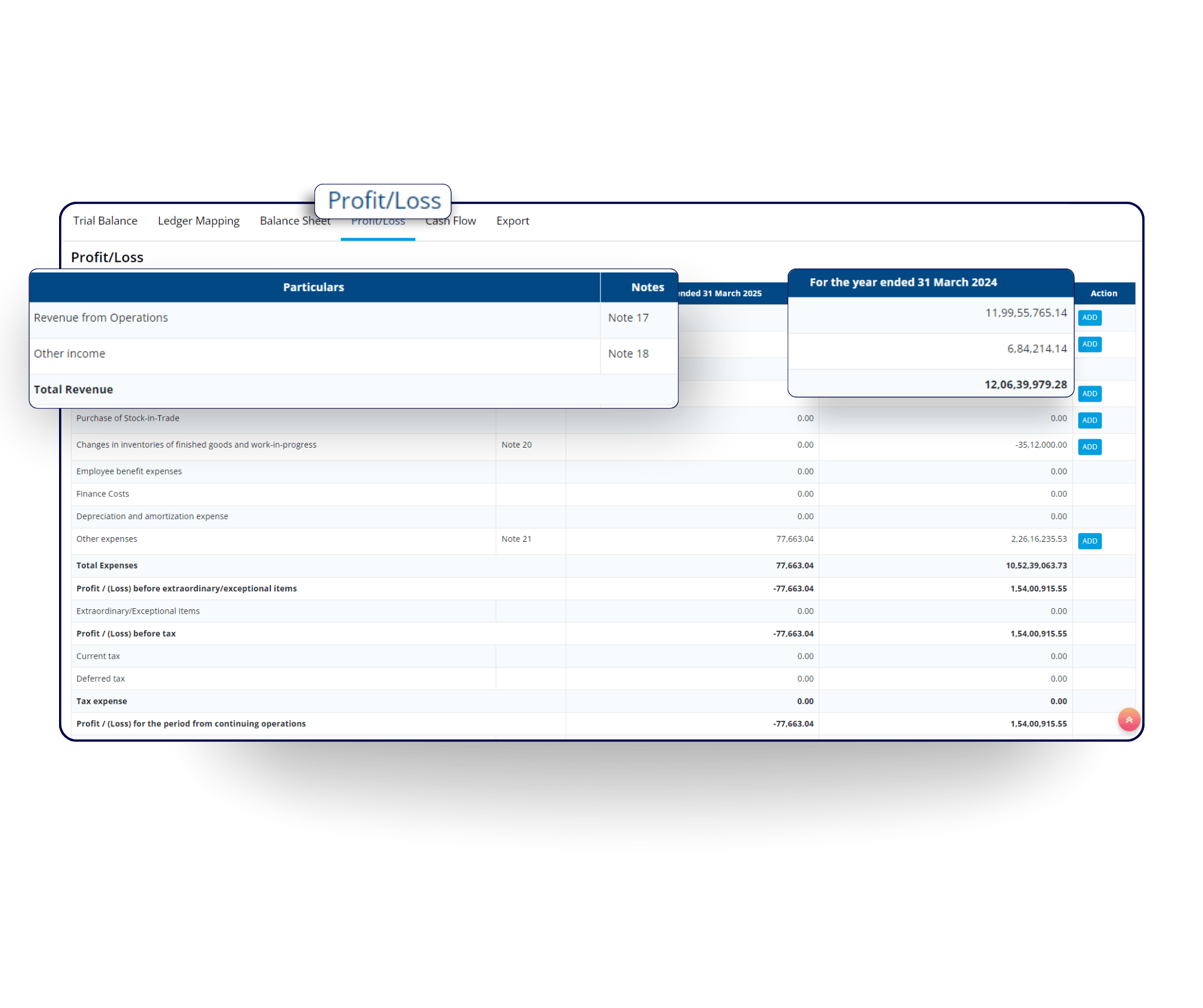

FS Module

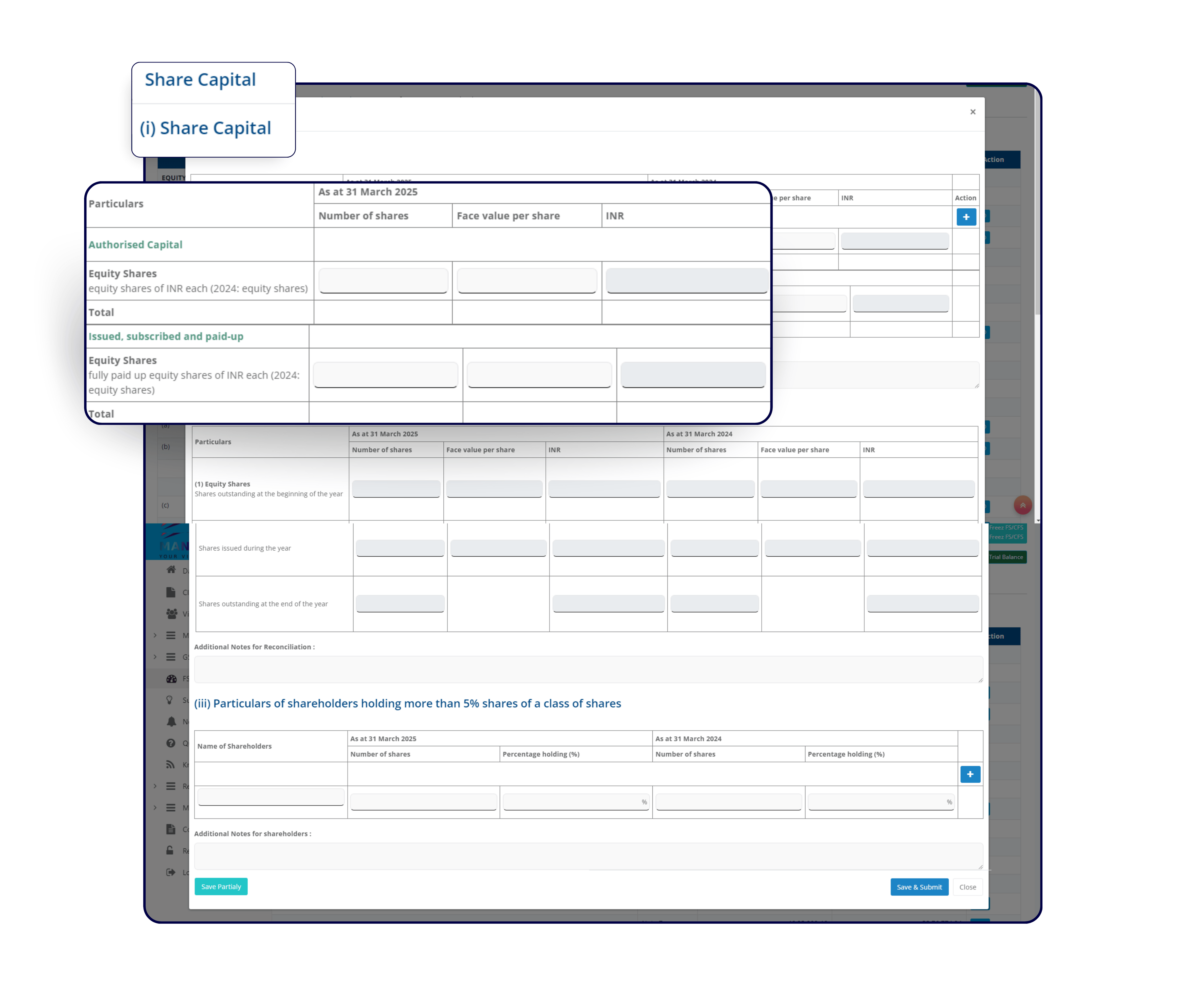

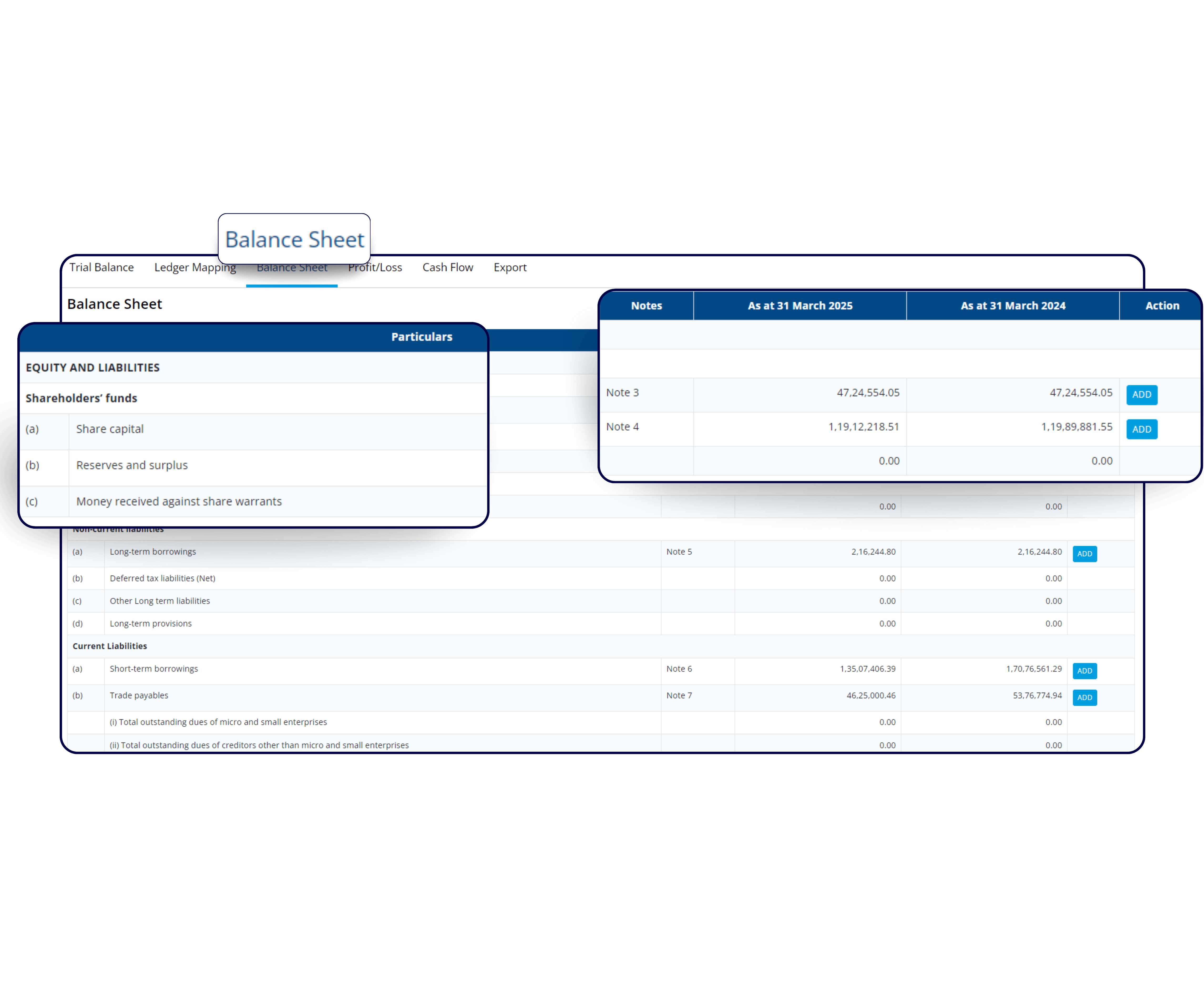

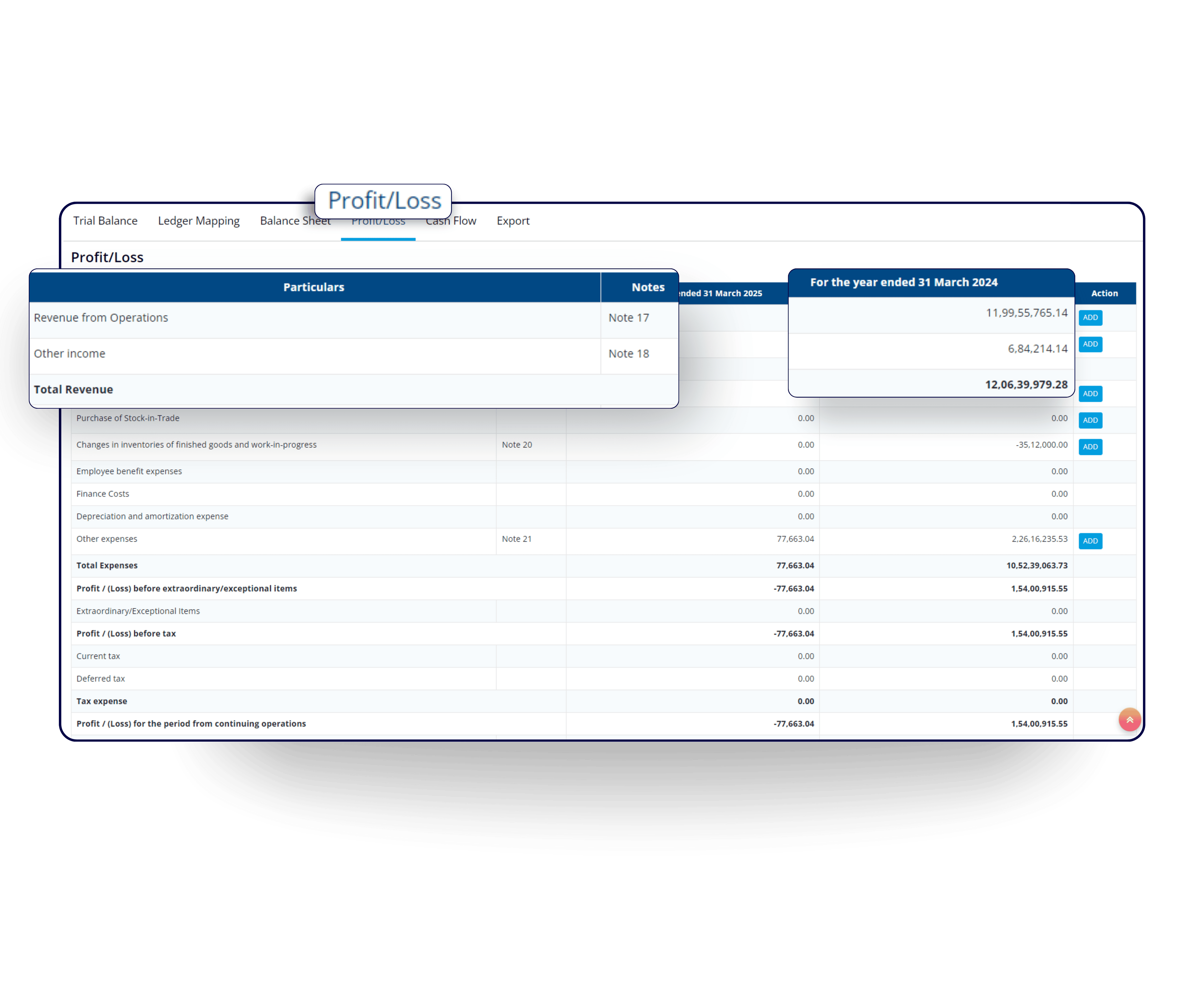

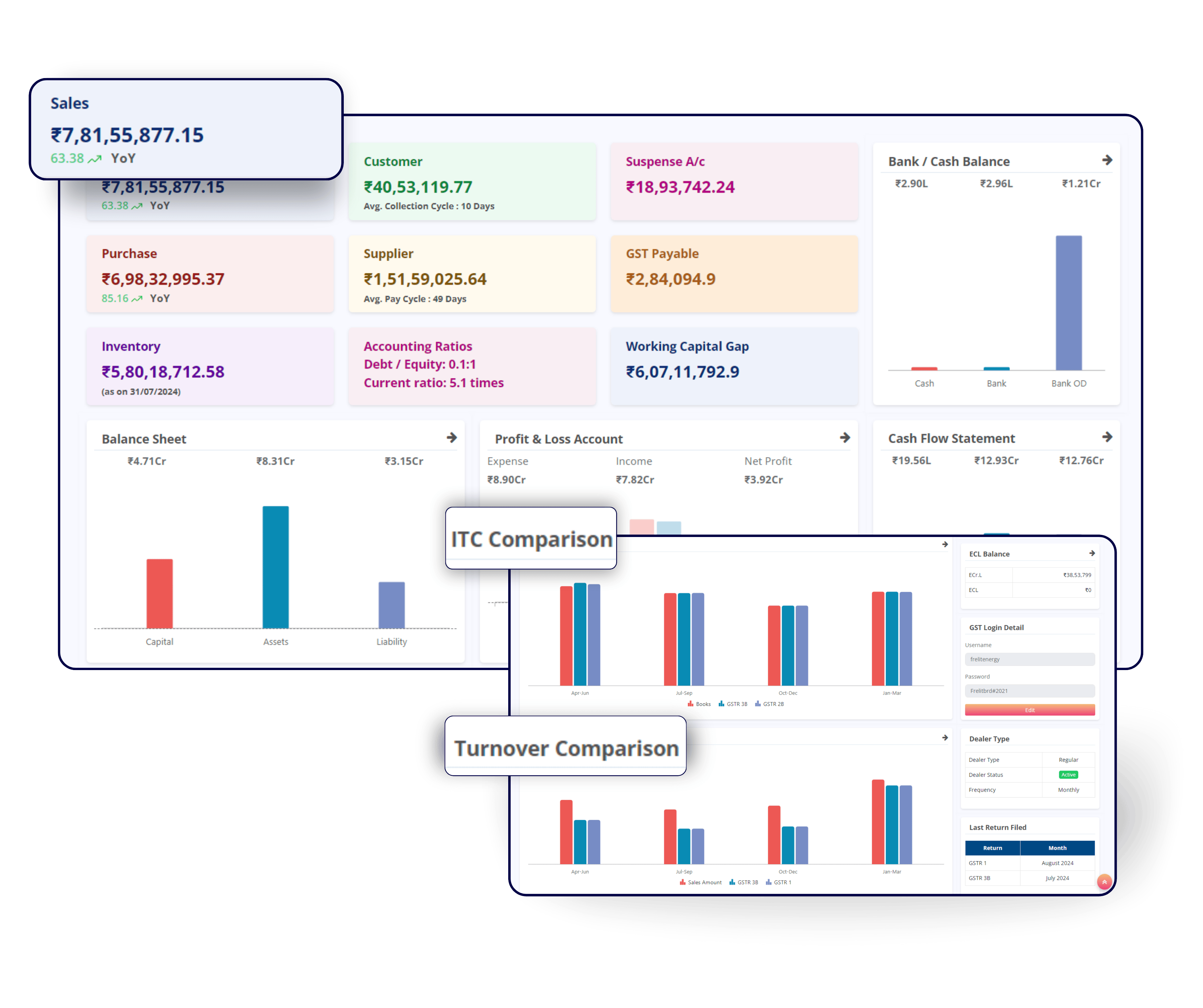

- AI based Preparation of Financial Statement as per Schedule III

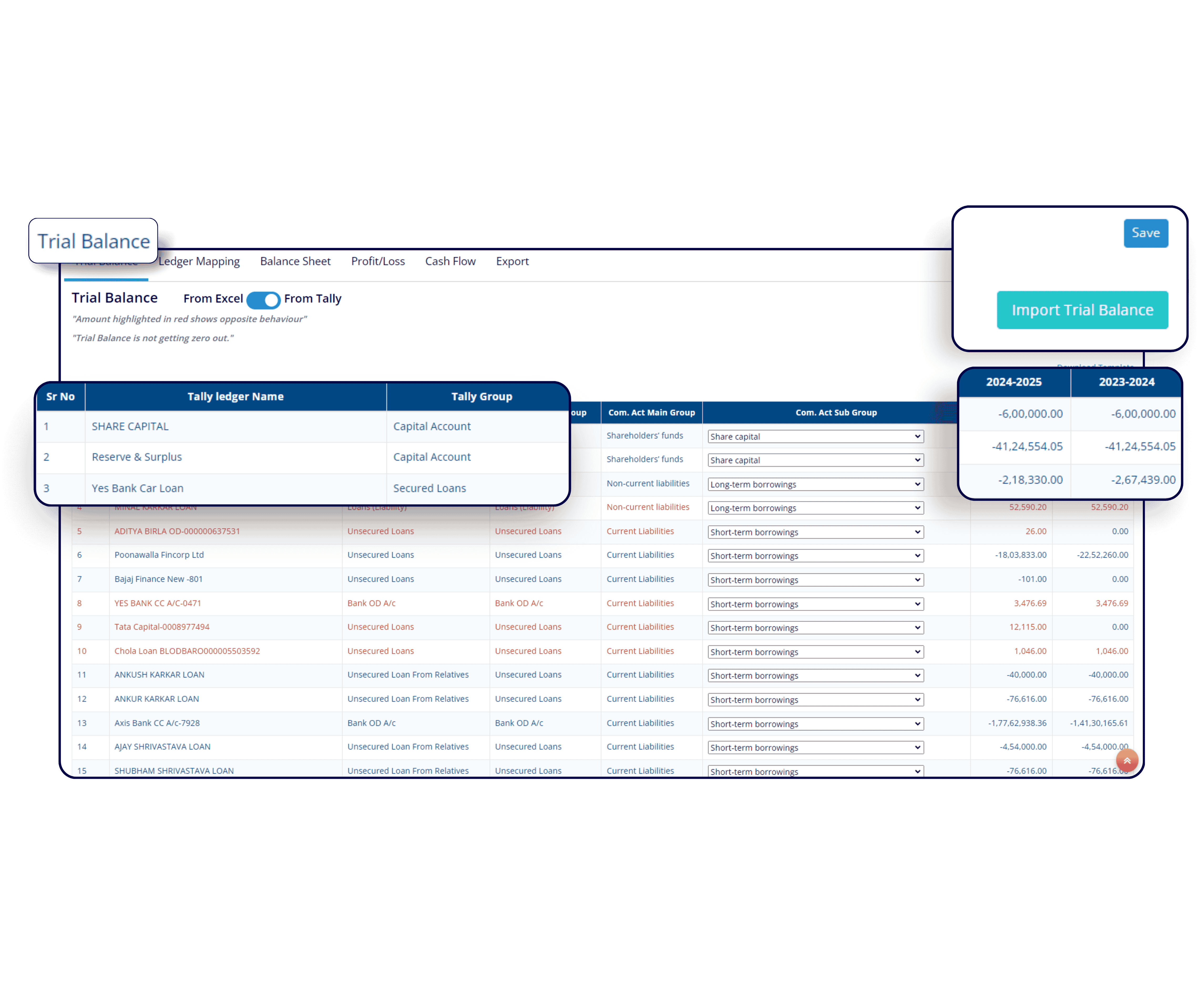

- Say goodbye to manual ledger mapping, our AI handles it for you.

- Generate Cash Flow Statement, Notes to FS, and Financial Ratios

- One time mapping and lifetime FS preparation

- TB linked FS in Excel

- Import directly from Tally or from Excel.

- FS preparation for Non-corporates also available.