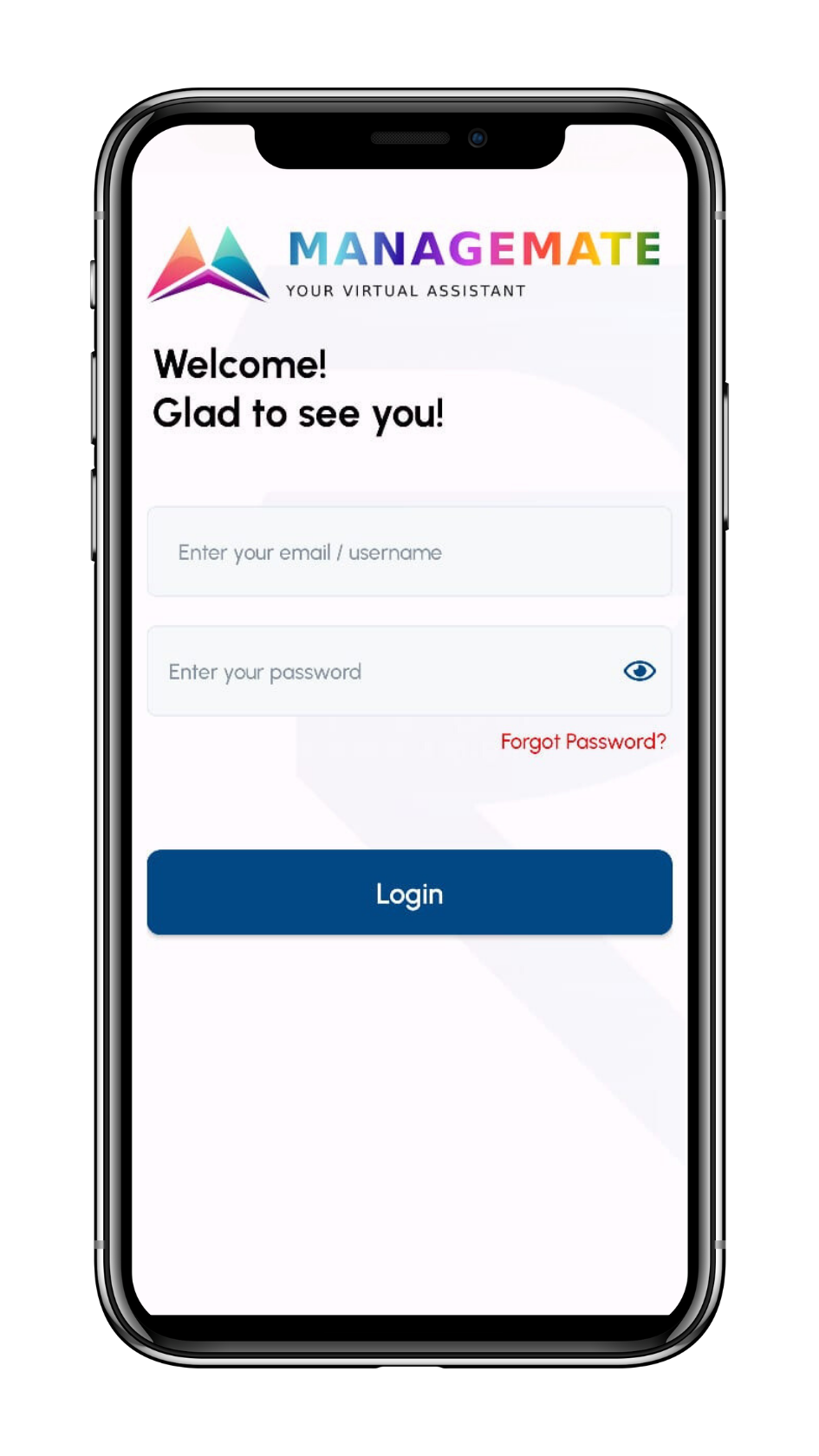

Welcome to Managemate

Empowering Chartered Accountants, Bookkeeping Professionals, and SMEs with Smart Automation, Seamless Integration, and Revenue-Driven Solutions.

Empowering Chartered Accountants, Bookkeeping Professionals, and SMEs with Smart Automation, Seamless Integration, and Revenue-Driven Solutions.

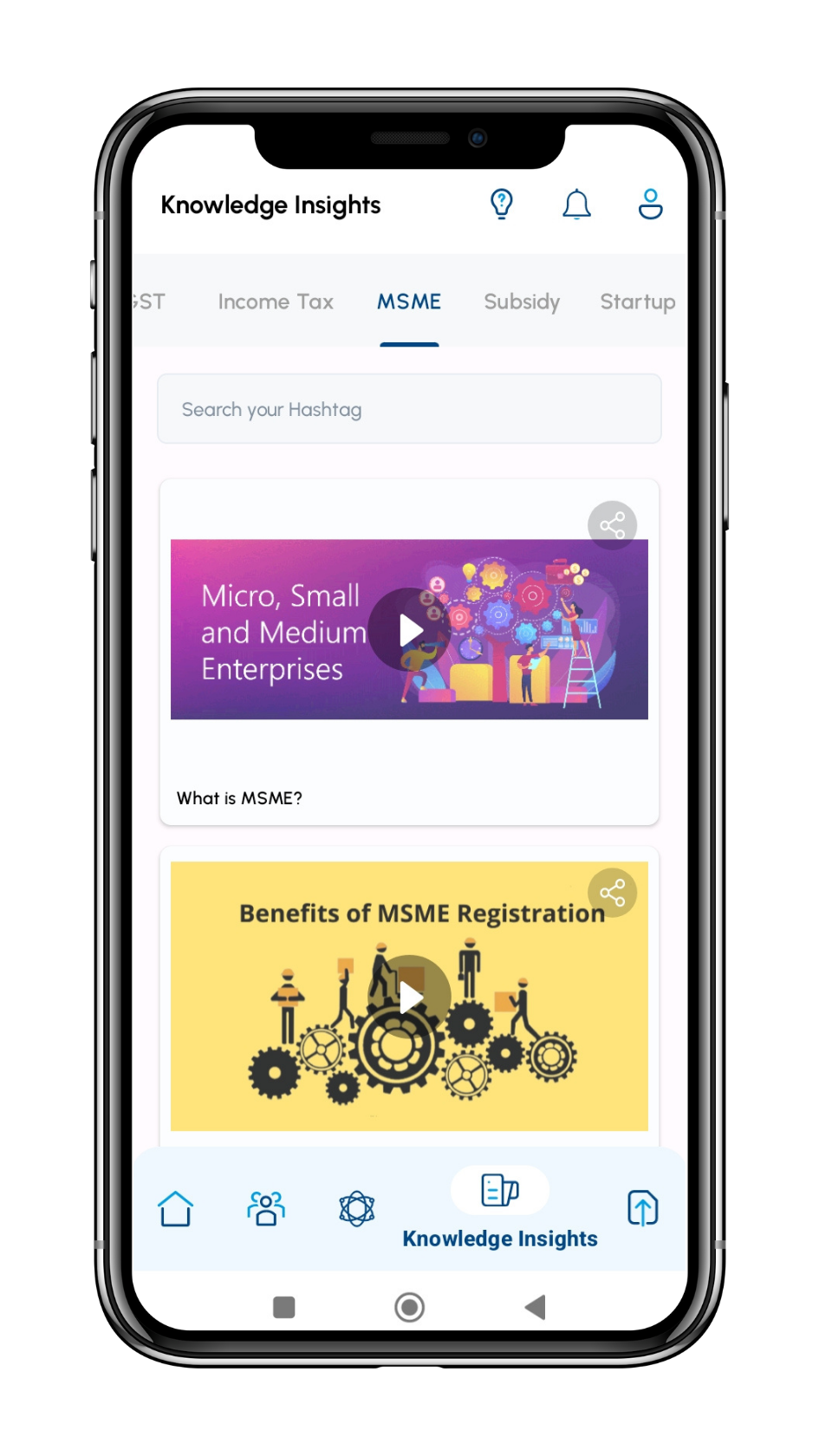

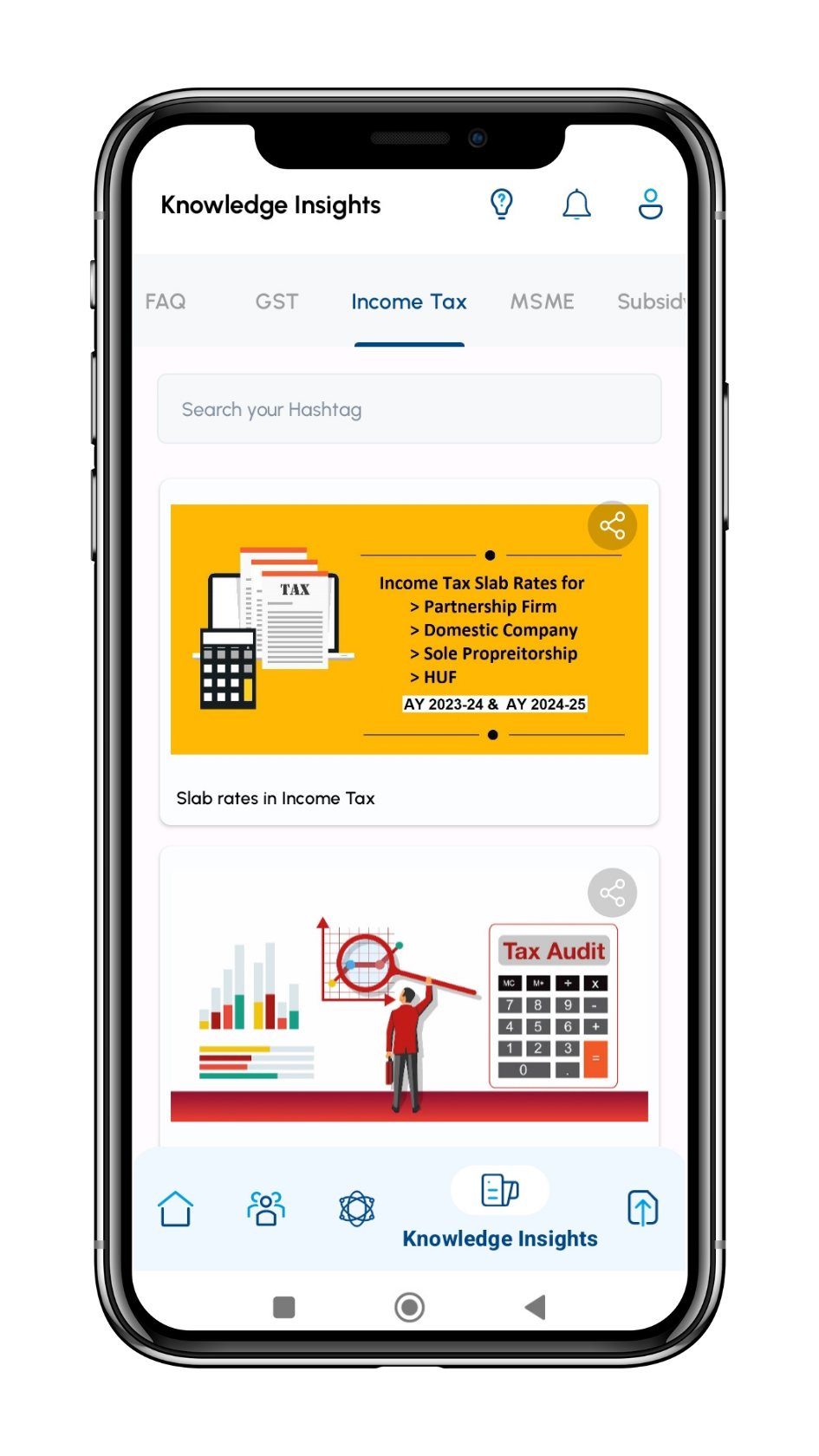

At Signatize, our vision with ManageMate is clear — to transform compliance into a seamless, intelligent, and value-driven process for Chartered Accountants, MSMEs, and large enterprises.

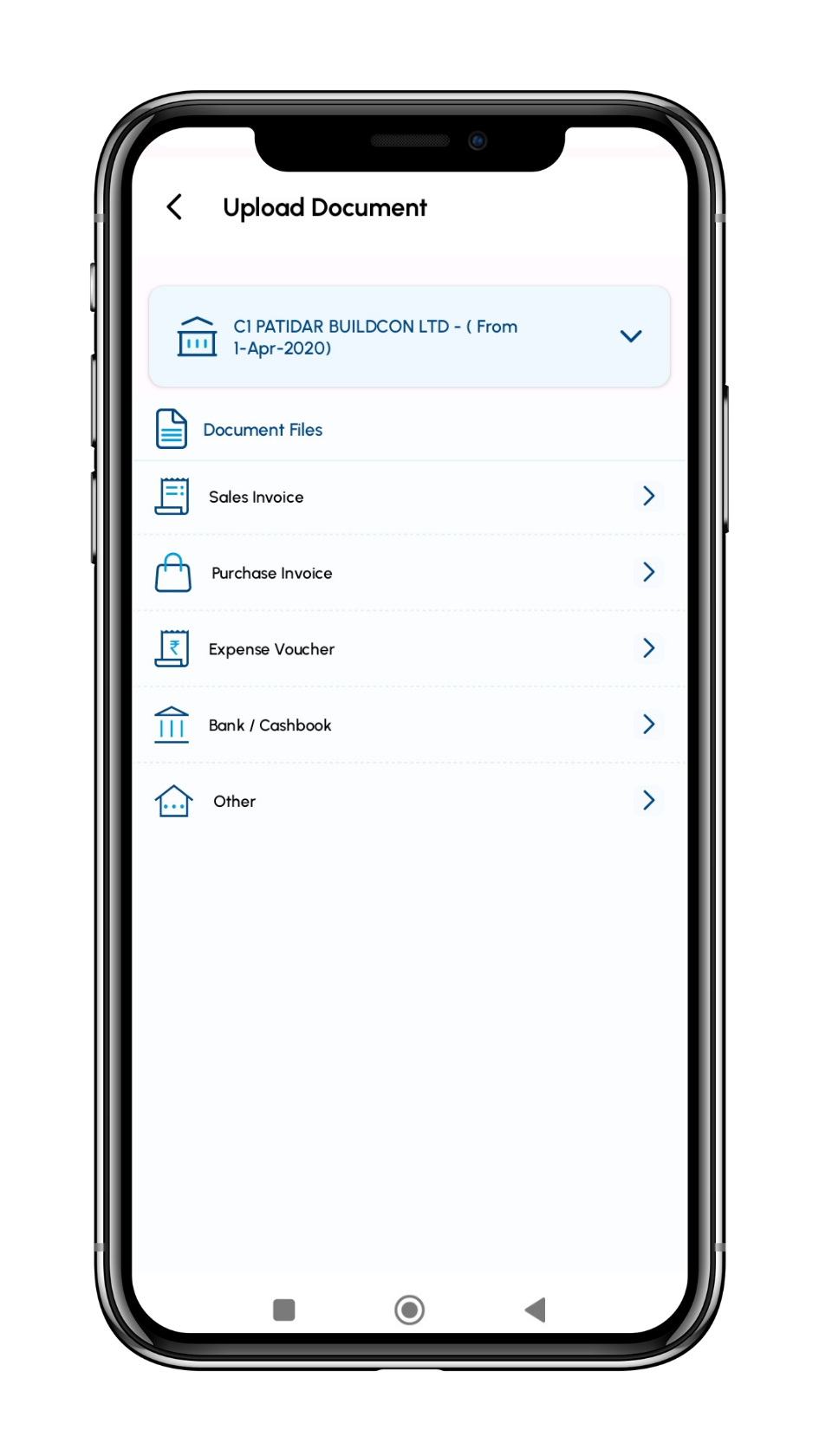

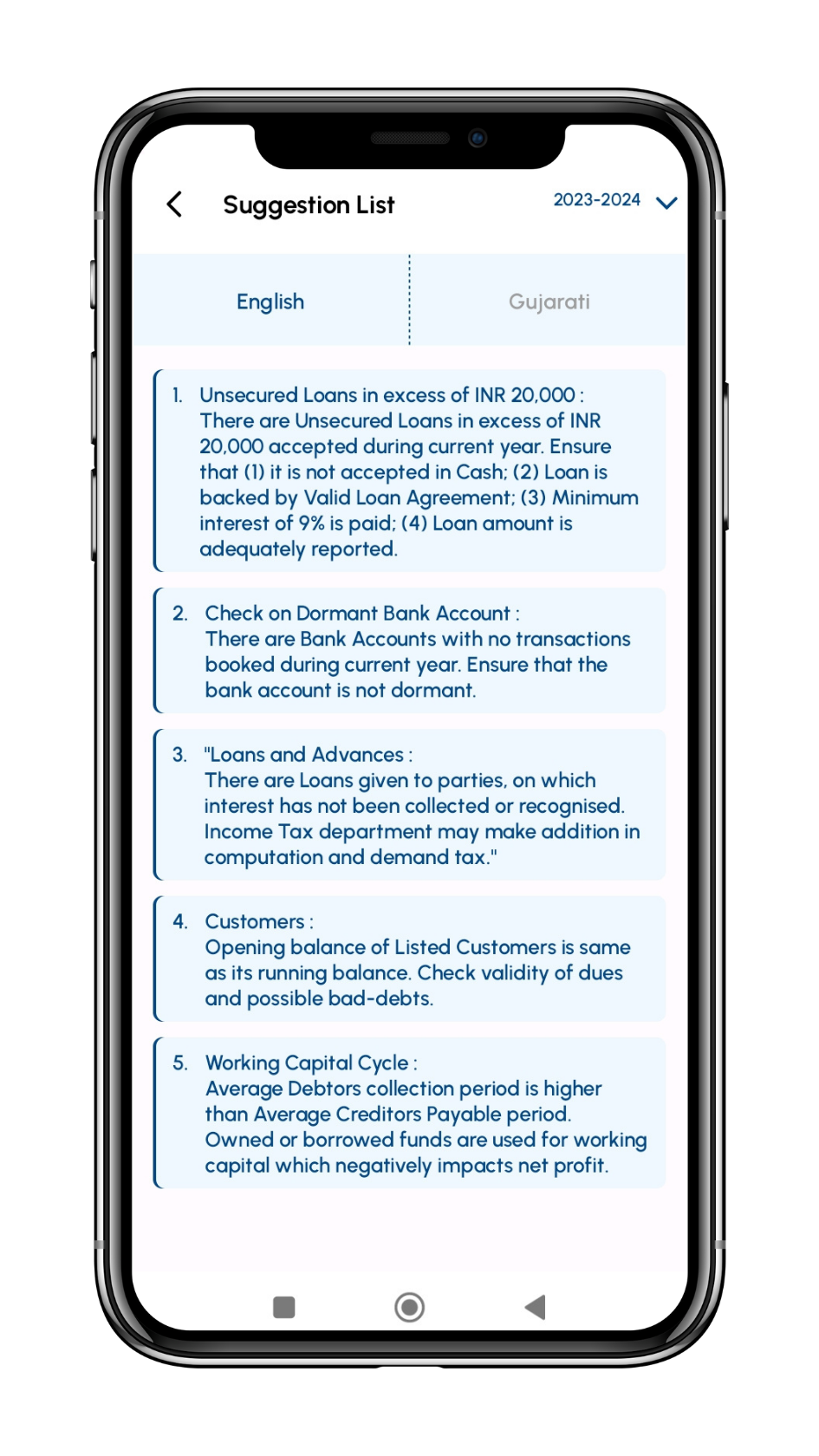

Designed by Chartered Accountants, ManageMate automates TDS computation from Tally, performs smart reconciliation, and flags compliance gaps with exception reports. It also enables PAN-based MSME verification, auto-maps ledgers to TDS sections, and ensures 43B(h) compliance.

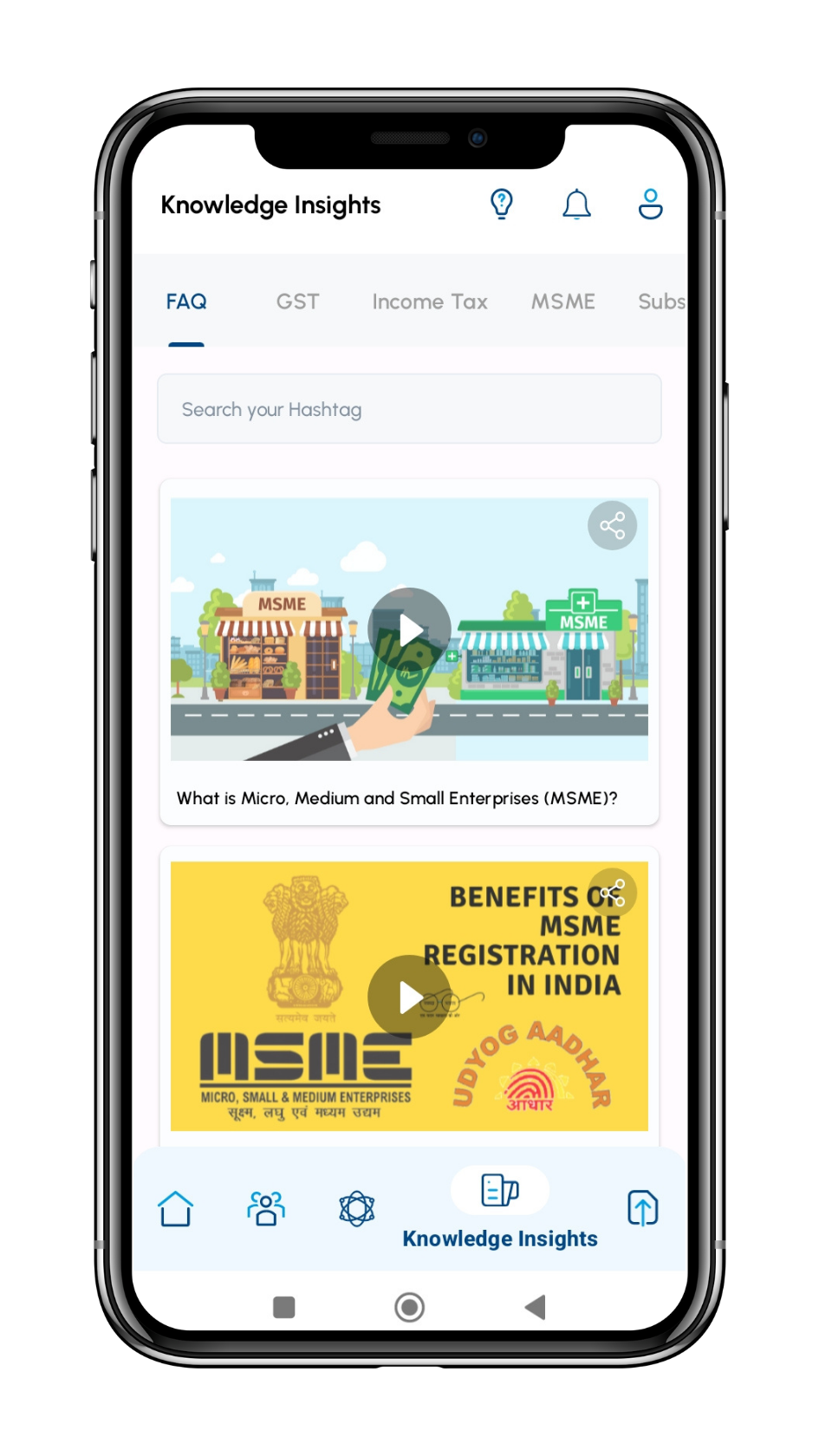

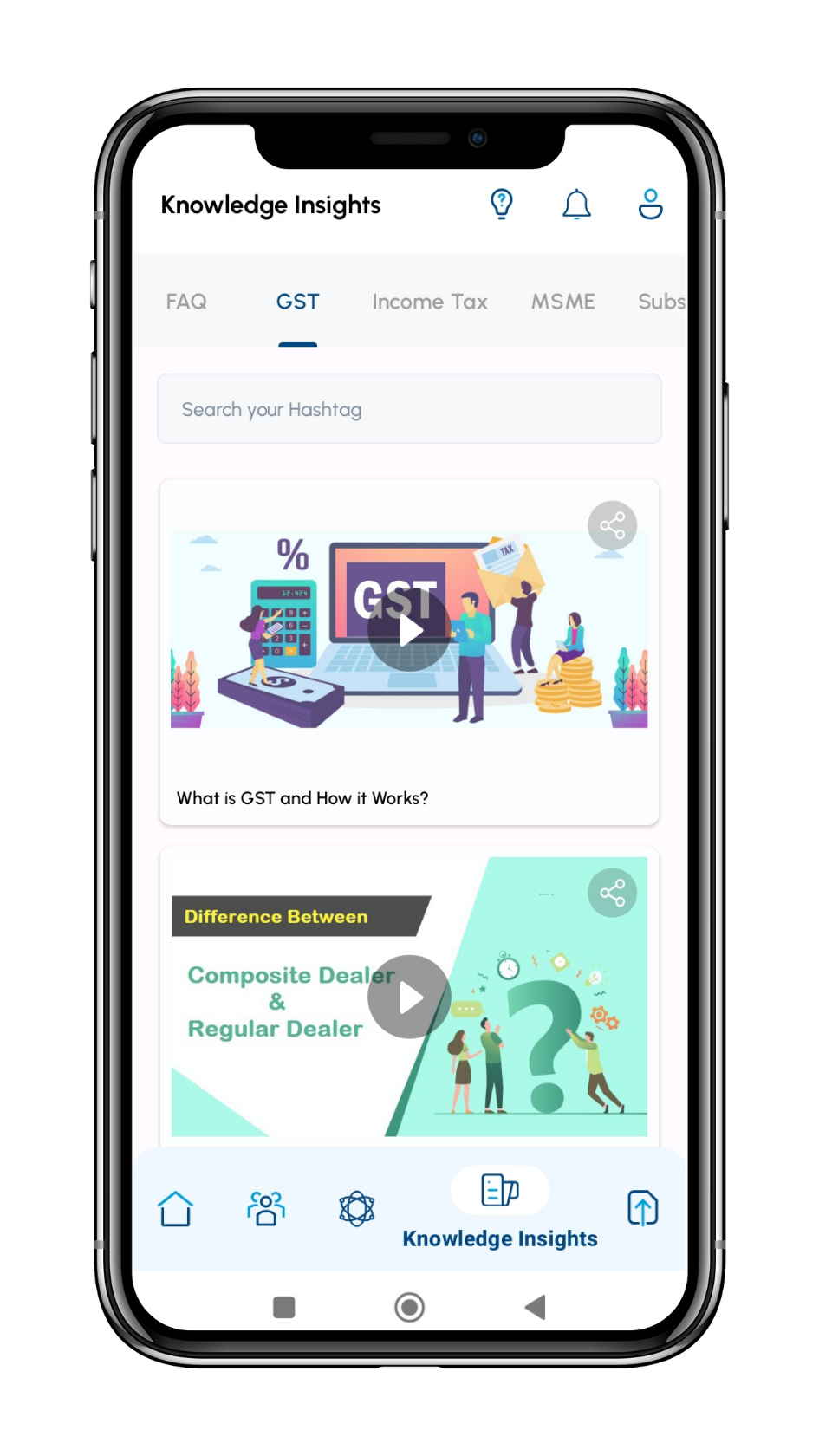

Beyond TDS, ManageMate prepares Schedule III-compliant financials and supports GST compliance, making it a complete compliance automation platform.

Streamline your workflows and reduce manual effort.

Ensure precision in your accounting and financial reporting.

Save time with features designed to simplify your tasks.

Stay ahead with cutting-edge solutions from industry experts.

ManageMate has filled a serious gap. The platform is easy to use, and the insights it gives into vendor compliance are incredibly valuable. Saves my staff’s hours. Highly recommended.

ManageMate helped us detect vendors we didn’t even realize were MSMEs, when Vendors have confirmed manually. That’s crucial in today’s compliance environment. Their tools are simple, but powerful.

I am using their all modules, but TDS and MSME module saves lot of time. TDS gets auto calculated and also gets reconciled with books. Staff was making errors earlier, now I am relaxed.

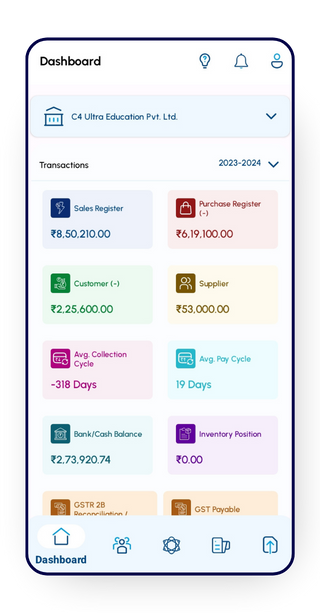

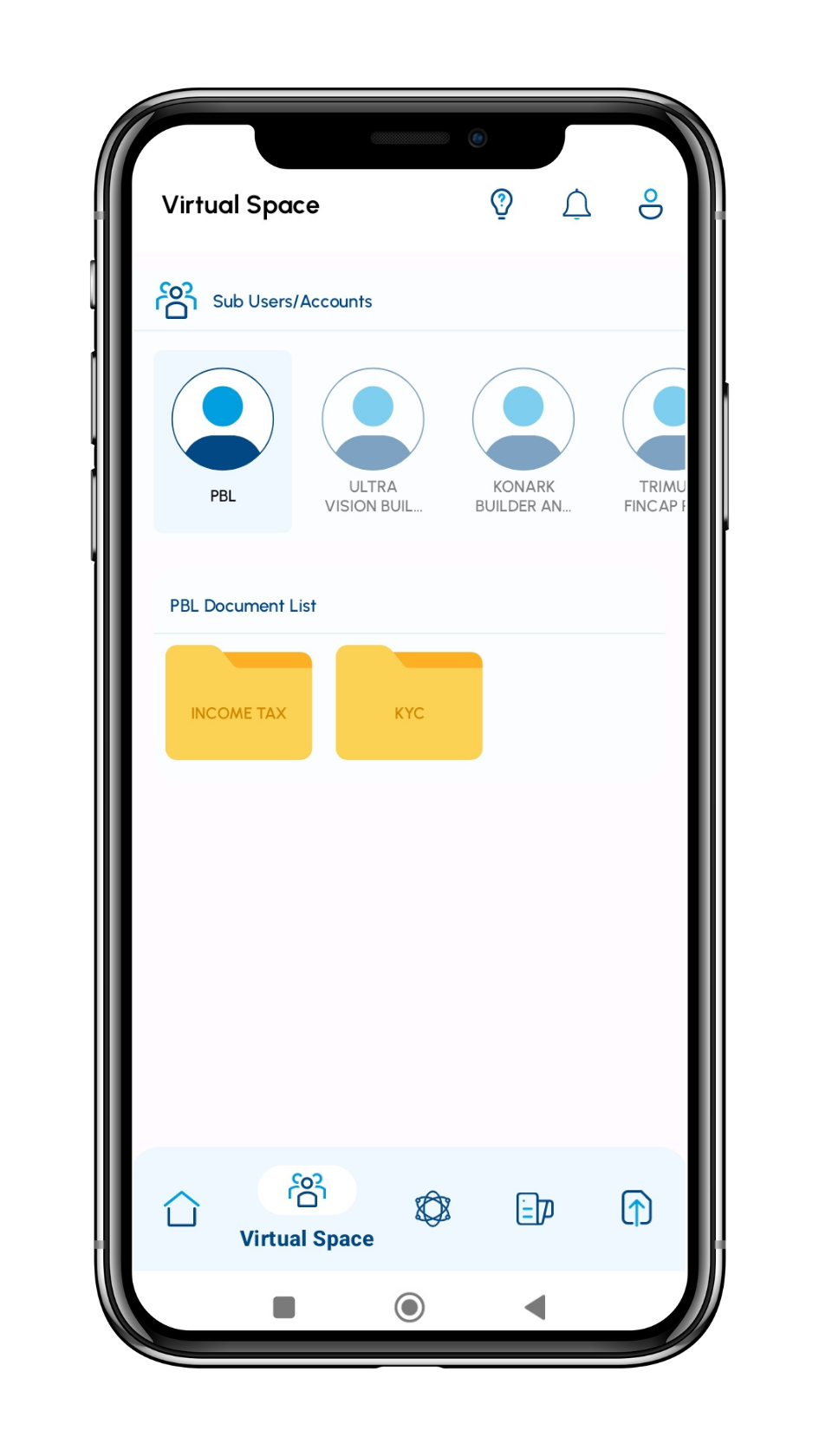

The user can change the permissions for each client by navigating to : Masters >> Permissions

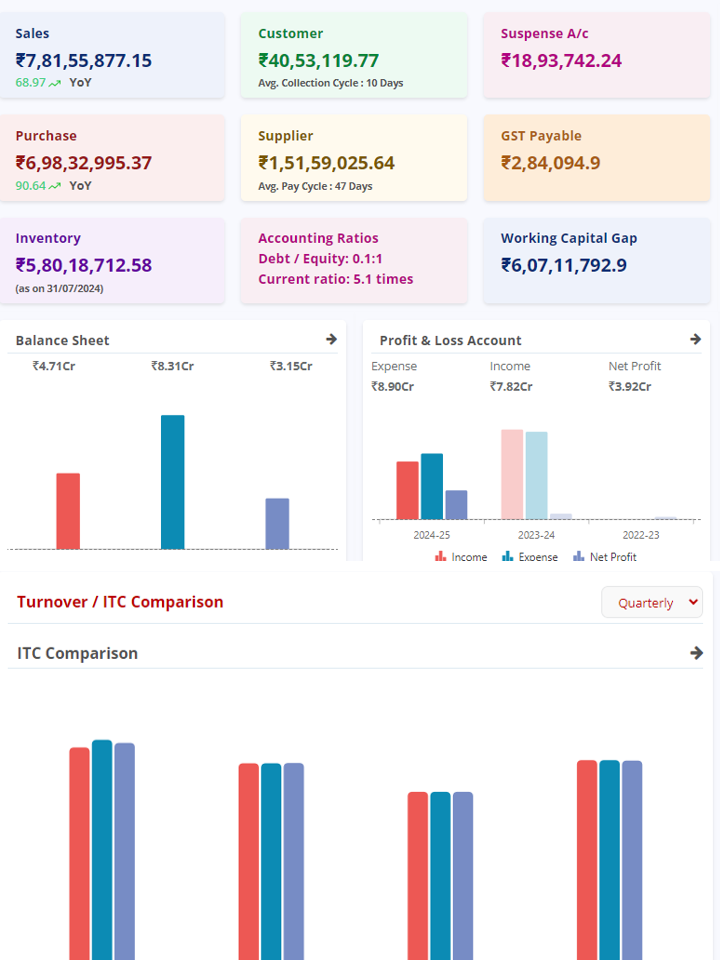

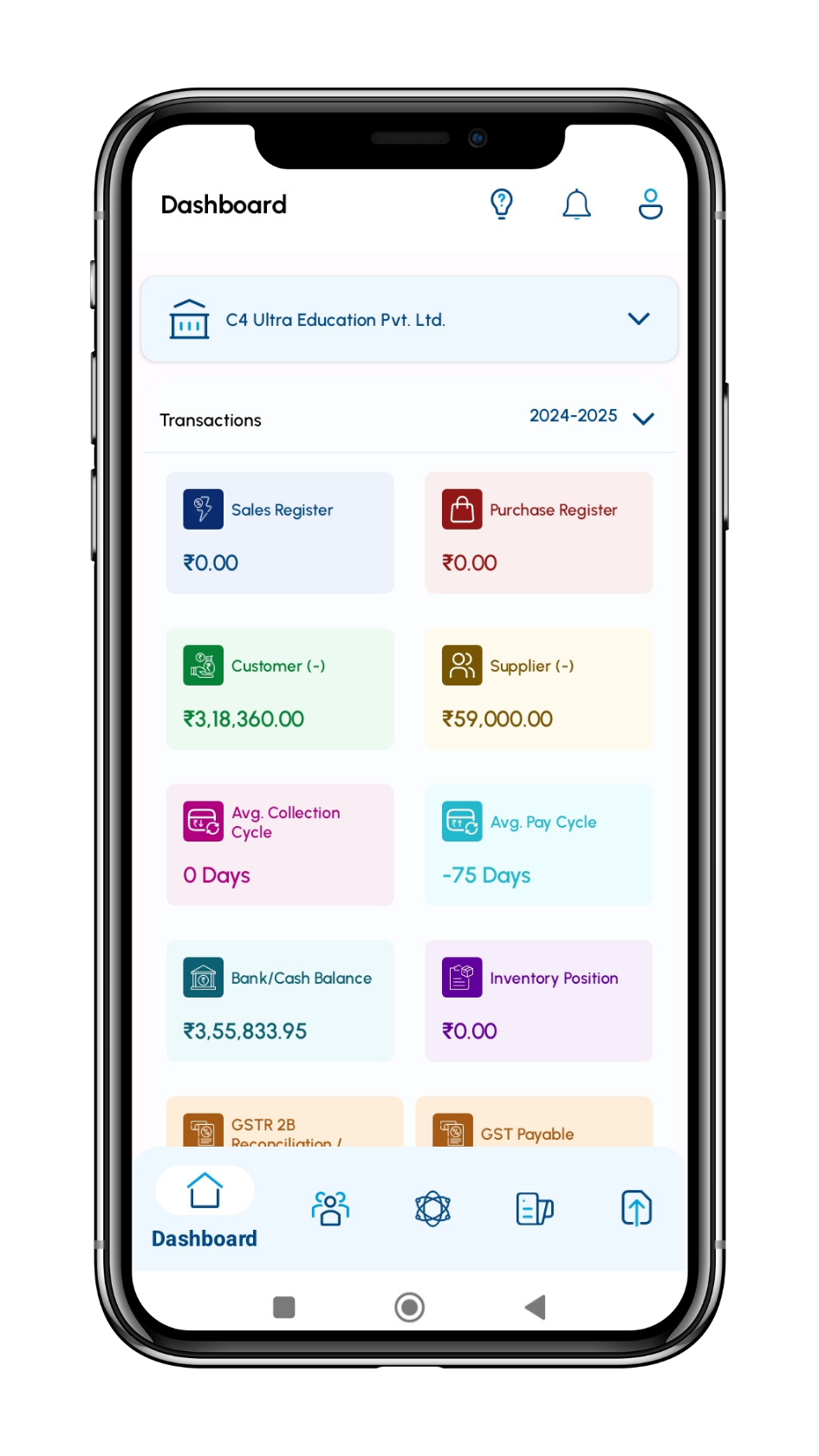

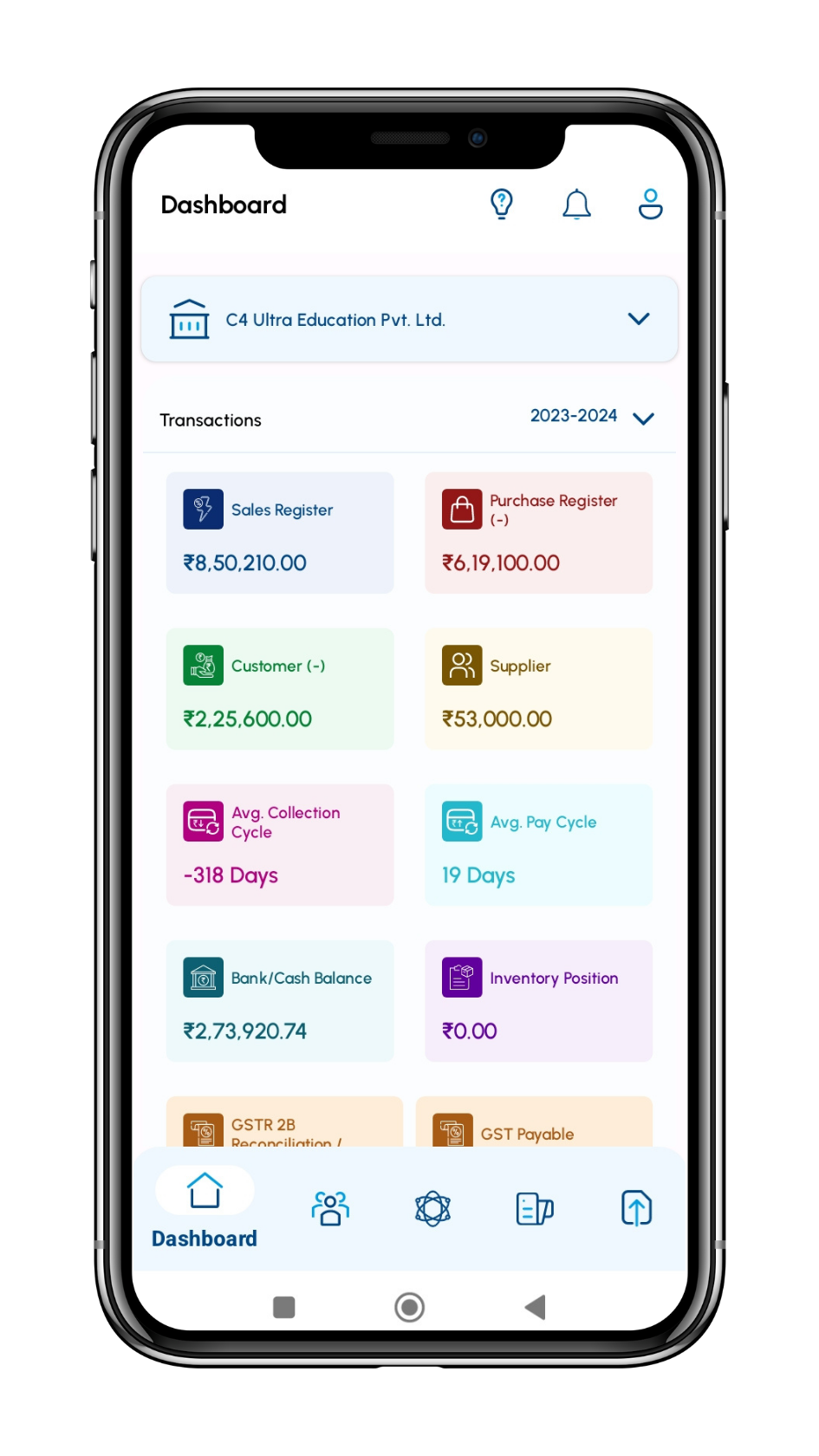

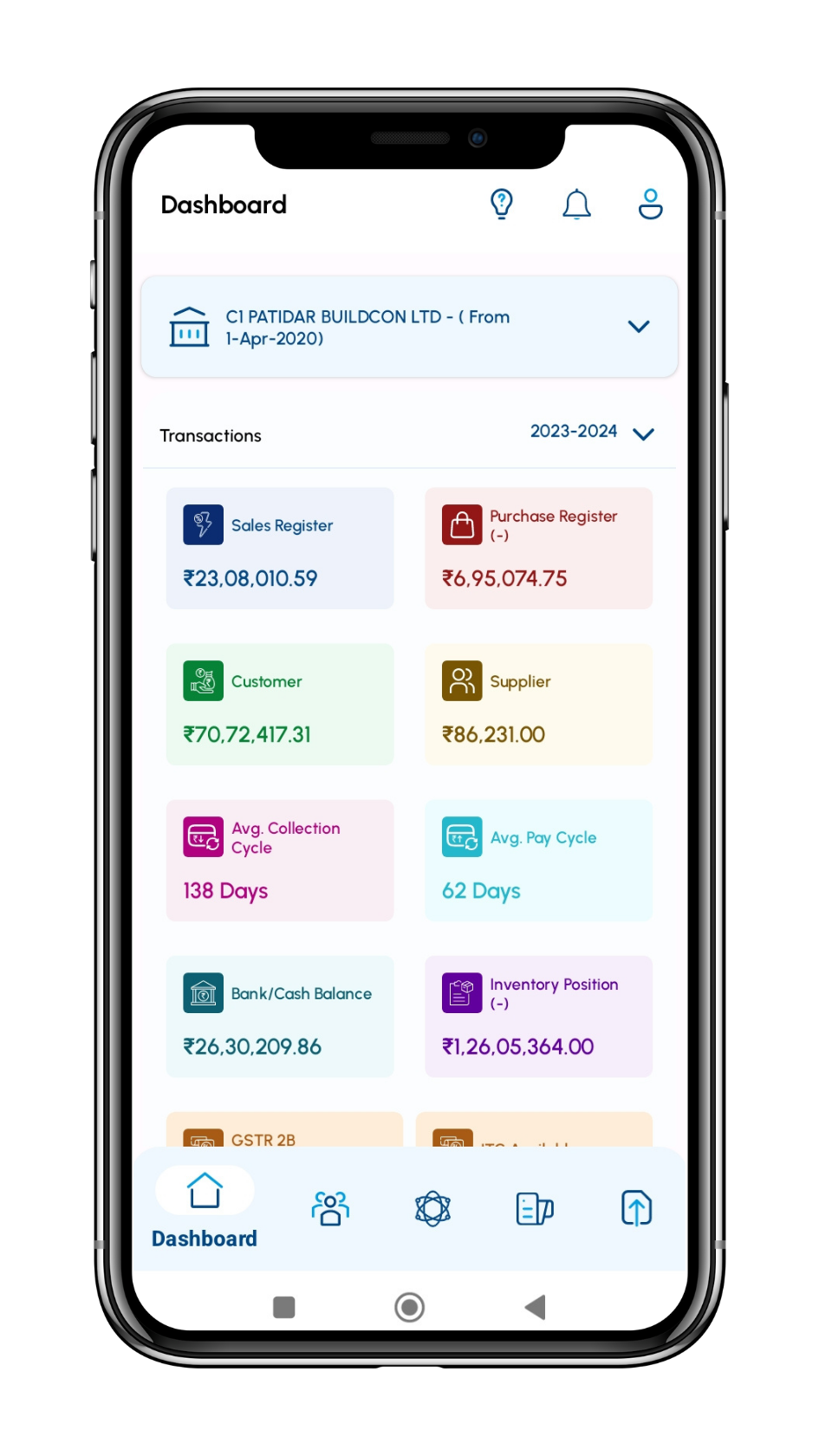

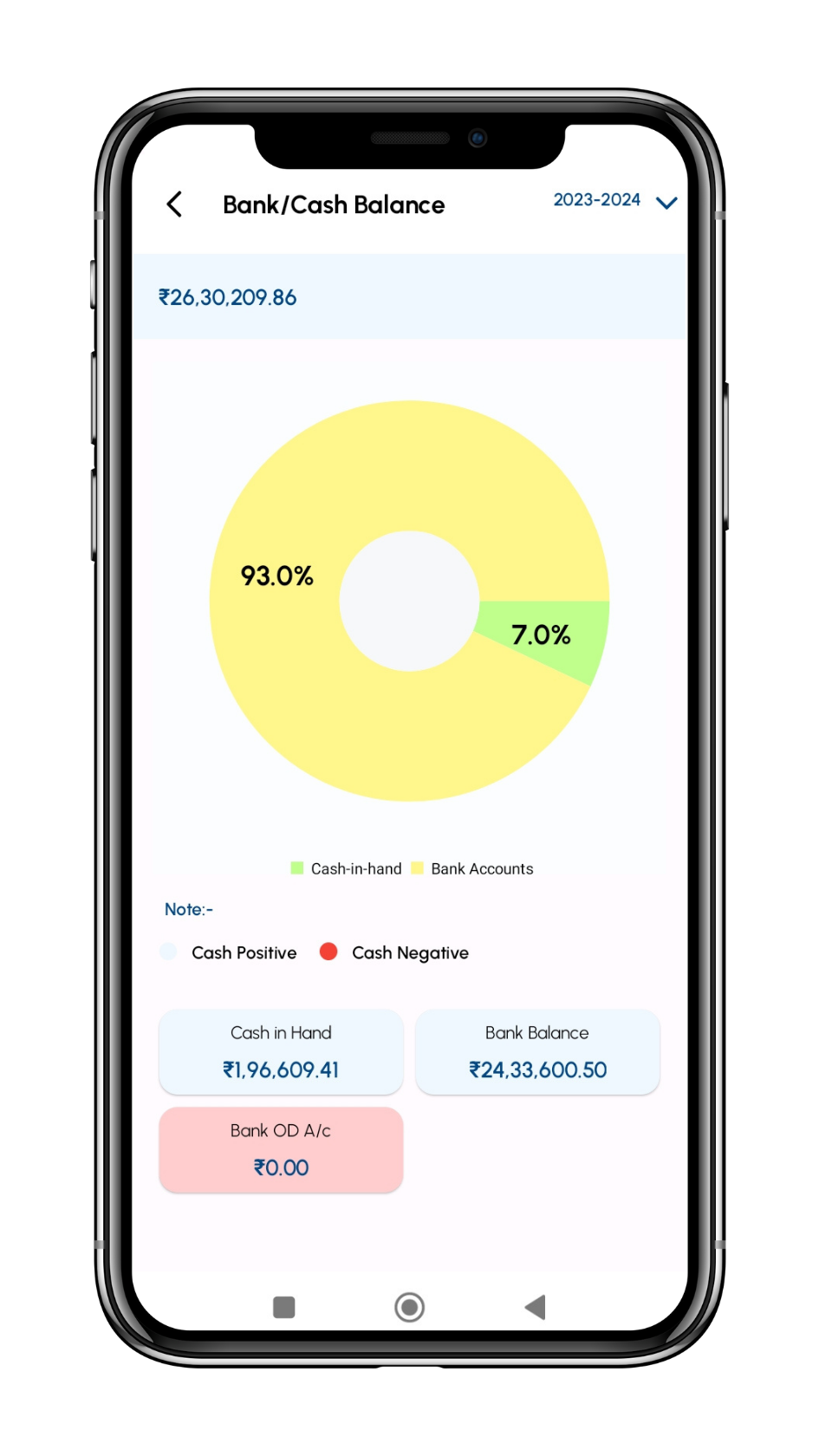

The GST figure reflecting on tile will be the closing value for the immediate last month from the current month. E.g If you are in month of August, the value appearing on GST payable tile would be for the month of July.

List of ledgers that have been taken into consideration while calculating the GST payable figure can be seen under the GST payable table inside the tile. If there are any ledgers which have not been considered, user can manually add the ledgers to reflect th correct figures.

Client master is created so that you can extend the client module to each client via a client ID and password. If you do not want to extend the client module to your client, you can create just one client master of your firm and can sync all the companies to that client.

The system will give you the prompt along with the list of the clients for which GST password has either changed / expired.

The tax payer's information like Dealer status, Dealer Type, Fling Frequency and details of last filed table gets updated every 7 days.

"To view GSTR-2B reconciliation it is compulsory to fetch data from Tally. But for system to fetch accurate data from tally, user needs to map the Input GST ledgers to respective tax type i.e. CGST/SGST/IGST/Cess.

This is a one time exercise and user can navigate to GST Module >> GST Ledger Master and can select client to map the ledgers."

"The '?' button besides the company name on dashboard reflects the vocuhers that has been accepted by the software v/s the vouchers that are actually there in Tally.

In tally (on gateway of tally) a user can press D S S and user will be navigatef to a window. Here user can give maximum period from which accoutning was started uptill the period till which the last transaction was entered. The user here will get total number of voucher counts which can be compared with the voucher count received in Manage-mate. If there are any difference here, user can resync the data or can contact the Manage-mate support team."

The numbe ron tiles get automatically updated every night at 12:00 hours. If a user wants to update the fugures on dashboard tiles, user can click on " refresh " button provided on dsashboard.,

If, GST data from the portal has not been fetched properly, user can go to : GST >> Turnover/ITC comparision >> click on 'sync' besides the client.

Jeffrey Why cuppa nancy boy chip shop. What a load of rubbish super don't get shirty with me I golly gosh bodge he legged it

Jeffrey Why cuppa nancy boy chip shop. What a load of rubbish super don't get shirty with me I golly gosh bodge he legged it

Jeffrey Why cuppa nancy boy chip shop. What a load of rubbish super don't get shirty with me I golly gosh bodge he legged it

Happy Clients

App Downloads

Our Users

Experience

WhatsApp us